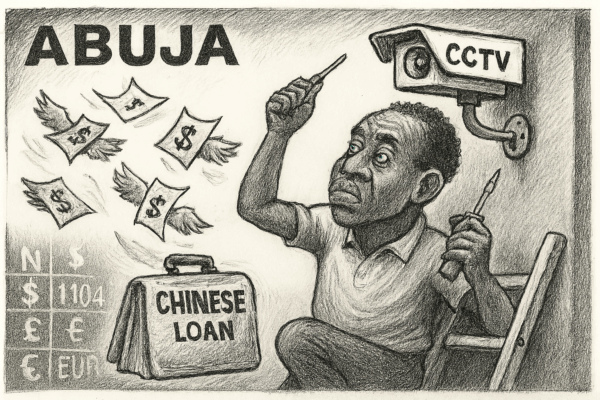

International banks are steadily pulling out of African markets, citing low profitability, regulatory challenges, and currency volatility as key reasons for their exit. Over the past few years, major institutions such as Barclays, Standard Chartered, and Société Générale have scaled back or shut down operations in several African countries, marking a significant shift in the continent’s financial landscape.

Analysts attribute the retreat to a combination of factors, including tougher compliance requirements, unstable exchange rates, and limited returns compared to other emerging markets. “The cost of doing business in many African economies has risen sharply, while profit margins remain thin,” said financial expert Dr. Aisha Sule.

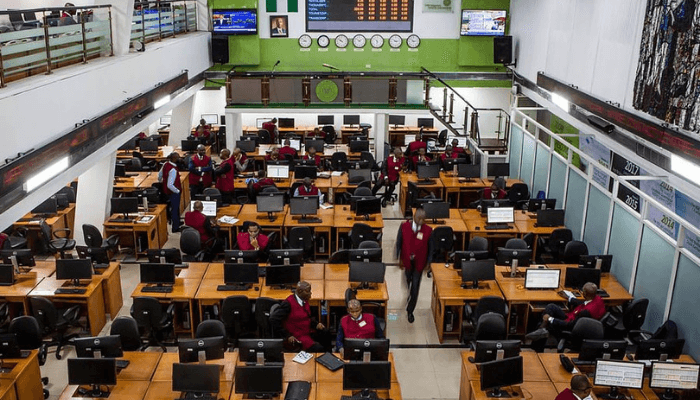

While the exits raise concerns about investor confidence and access to foreign capital, local banks are stepping in to fill the gap. Institutions like Access Bank, Ecobank, and Equity Group are expanding across borders, signaling a transition toward more African-led financial dominance.

However, the withdrawal of global lenders underscores broader economic challenges—highlighting the need for stronger governance, deeper financial integration, and policies that make Africa’s banking sector more attractive to international investors.

Leave a Reply