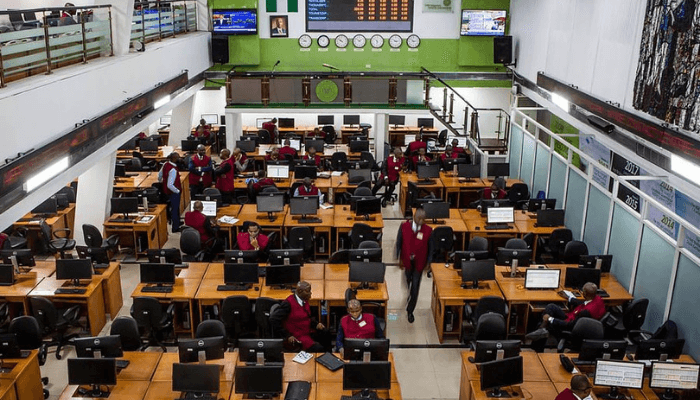

Nigeria’s stock market reached a historic milestone this week as the Nigerian Exchange (NGX) crossed the ₦100 trillion market capitalization mark for the first time, driven by strong performances from Beta Glass Plc and Ellah Lakes Plc.

Market analysts attribute the record-breaking surge to renewed investor confidence, increased participation from institutional investors, and rising interest in agro-industrial and manufacturing stocks.

Beta Glass, a leading glass packaging manufacturer, recorded significant gains following reports of expansion plans and increased export potential, while Ellah Lakes, an agribusiness firm, attracted attention with its ongoing restructuring and diversification projects across West Africa.

“This is a major turning point for Nigeria’s capital market,” said an NGX analyst. “It reflects a return of investor optimism and the resilience of key sectors driving real growth.”

The ₦100 trillion benchmark places Nigeria among Africa’s largest equity markets by capitalization, signaling a recovery in local and foreign investor sentiment despite economic headwinds.

Financial experts say the next challenge will be sustaining this growth through stronger corporate governance, consistent policies, and diversification of listed companies.

With the performance of Beta Glass, Ellah Lakes, and other high-performing stocks, the NGX’s latest rally is being hailed as a sign that Nigeria’s equities market is entering a new era of expansion and investor confidence.

Leave a Reply