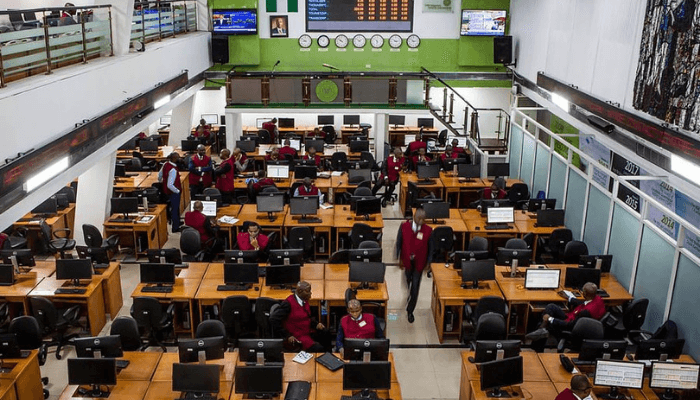

As Nigeria’s financial markets gear up for a decisive year, investors are closely comparing two of the country’s most prominent banking giants United Bank for Africa (UBA) Plc and FBN Holdings Plc (FirstHoldco) to determine which offers better value and long-term returns in 2025.

Both institutions delivered strong performances in 2024, driven by higher interest income, digital expansion, and improved foreign exchange gains. However, analysts say their 2025 outlooks differ in strategy, valuation, and investor appeal.

According to market data from the Nigerian Exchange Group (NGX), UBA’s share price has risen sharply over the past year, supported by robust profit growth and its expanding pan-African presence. The bank’s consistent dividend payouts and solid balance sheet have also strengthened investor confidence.

In contrast, FBN Holdings, the parent company of First Bank of Nigeria, has shown renewed momentum under its restructuring plan. Analysts credit its improved asset quality, governance reforms, and digital banking innovation as key factors driving its recovery and growth potential.

“UBA remains a growth-driven stock with strong regional earnings diversification, while FBN Holdings is a turnaround story that could reward long-term investors,” said a Lagos-based financial analyst.

A comparison of their price-to-earnings ratios (P/E) and dividend yields shows UBA currently trades at a modest premium due to its stable performance, while FBN Holdings offers slightly higher upside potential if it maintains its current trajectory.

Both stocks are rated as “Buy” by several equity analysts, reflecting confidence in the resilience of Nigeria’s banking sector amid economic reforms and rising investor interest in financial equities.

Ultimately, experts suggest that UBA may appeal to investors seeking stability and consistent returns, while FBN Holdings could attract those looking for growth and value recovery opportunities in 2025.

Leave a Reply