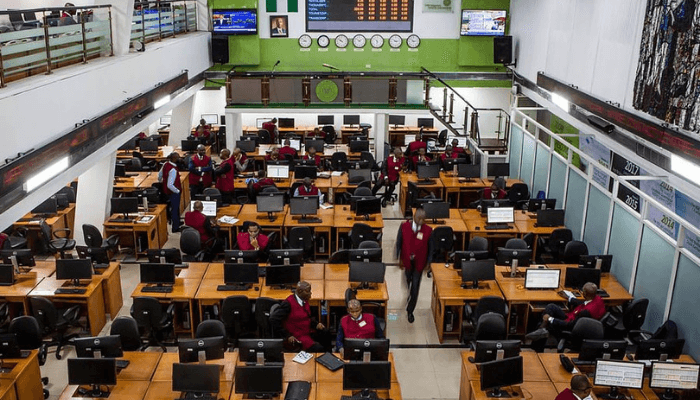

The Central Bank of Nigeria (CBN) has formally taken over the management of fixed income securities trading, a move analysts say could reshape the dynamics of the nation’s financial markets.

The shift, which transfers oversight from the FMDQ Exchange to the apex bank, is aimed at tightening regulatory control, enhancing transparency, and ensuring stability in the trading of government bonds and treasury bills.

According to the CBN, the move is designed to safeguard investors’ confidence and streamline operations in a market that remains central to government borrowing and liquidity management.

Market experts, however, are divided on the implications. While some argue that the CBN’s direct involvement will foster discipline and reduce risks of manipulation, others warn that it could stifle innovation and reduce the independence of market structures.

Financial analyst, Adeolu Adesina, told reporters that “the central bank’s control could bring short-term stability, but long-term, it raises questions about competition and efficiency in pricing.”

The development comes at a time when Nigeria is seeking to deepen its capital market and attract more foreign portfolio investments. Investors will be closely watching how the CBN balances its dual role as a regulator and a market participant.

With the apex bank’s intervention, stakeholders say the coming months will reveal whether the takeover strengthens Nigeria’s fixed income market or introduces new challenges.

Leave a Reply