Nigerian banks are trading at a discount on the stock market as recent foreign exchange (FX) gains show signs of cooling, dampening investor sentiment.

Market analysts note that the rally in the naira, which had spurred optimism across financial stocks in recent weeks, is losing momentum. As a result, banking shares that previously benefitted from improved FX positions are now facing renewed pressure.

“Investors are becoming cautious as the initial FX rebound appears to be stabilizing. The expectation of sustained gains in the naira is no longer as strong, and that has reflected in bank valuations,” a Lagos-based equities analyst said.

Despite the discount, experts argue that the fundamentals of tier-one lenders remain strong, suggesting potential for medium-term recovery once monetary policy signals become clearer.

The development comes at a time when Nigeria’s financial markets are closely watching the Central Bank’s next steps in managing liquidity, interest rates, and FX interventions.

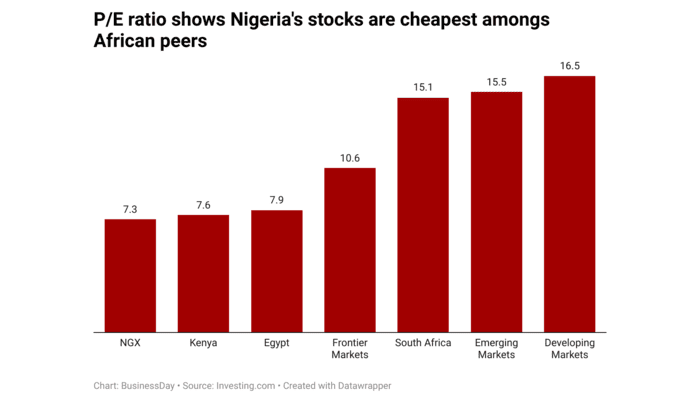

Banking stocks have historically been a key driver of the Nigerian Exchange (NGX), but their current undervaluation underscores the uncertainty facing the sector as FX pressures linger.

Leave a Reply