The Niger Delta Power Holding Company (NDPHC) has raised alarm over the deepening crisis in Nigeria’s electricity sector, revealing that over ₦600 billion owed by market operators has left more than 2,000 megawatts of power stranded across its generation plants.

Speaking at a stakeholders’ forum in Abuja on Monday, the company’s Managing Director, Chiedu Ugbo, described the situation as both “unsustainable and damaging,” warning that the unpaid debts continue to undermine operations and investment in the power sector.

“We currently have over 2,000MW of generation capacity that is not being utilized due to transmission and distribution constraints, coupled with the inability of market participants to meet their financial obligations,” Ugbo said.

The NDPHC, which operates under the National Integrated Power Project (NIPP), said despite having the infrastructure and capacity to deliver reliable power, many of its plants are underutilized due to persistent liquidity challenges, poor grid evacuation infrastructure, and inefficiencies in the electricity value chain.

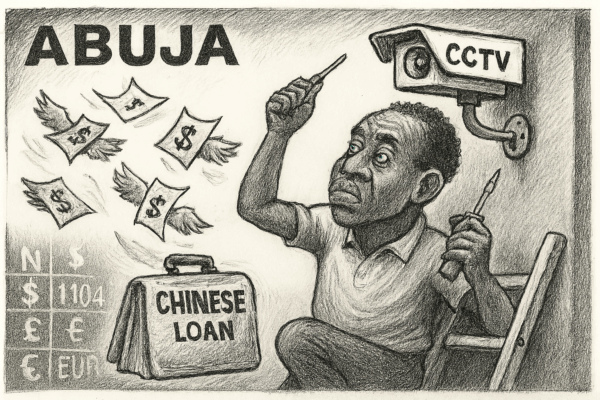

The ₦600 billion debt, according to the agency, has piled up over several years from unpaid invoices by the Nigerian Bulk Electricity Trading (NBET) company and other market players, reflecting deep-rooted structural problems in the sector.

Industry experts warn that continued financial shortfalls could force some power plants into shutdown, worsening the country’s already inadequate electricity supply and stalling ongoing reforms.

Despite repeated interventions by the federal government, Nigeria’s electricity sector has struggled with low collection rates, weak transmission networks, and a lack of cost-reflective tariffs — all of which contribute to mounting debts and stranded generation capacity.

The NDPHC has called for urgent policy action, including the implementation of credible payment mechanisms and targeted investments in grid infrastructure to unlock its dormant capacity.

Meanwhile, the Federal Ministry of Power says it is working with stakeholders to address liquidity issues and create a more commercially viable electricity market that can support both generation and distribution growth.

Leave a Reply