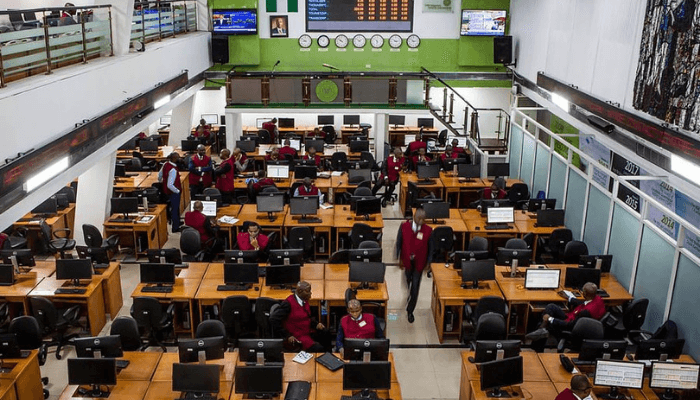

Foreign participation in the Nigerian equities market has sharply declined, with transactions falling by 91% to ₦63 billion in April, according to the latest data released by the Nigerian Exchange Limited (NGX).

The figure represents a stark drop from ₦707.5 billion recorded in March, raising concerns among market analysts about investor confidence and external interest in the country’s financial markets.

Analysts attribute the plunge to a combination of global economic uncertainties, foreign exchange volatility, and Nigeria’s lingering macroeconomic challenges, including inflation and monetary policy tightening.

“International investors remain wary of repatriation risks and policy inconsistencies. The sharp decline reflects a growing preference for safer and more stable markets,” said financial analyst Tola Adeniji of Vetiva Capital.

While domestic investors remained dominant, accounting for 87% of total transactions, the withdrawal of foreign capital has sparked calls for stronger policy signals and investor-friendly reforms.

In response, the Securities and Exchange Commission (SEC) reiterated its commitment to improving market transparency and ease of access for international investors.

“We’re working closely with stakeholders to restore confidence in the market and attract long-term capital,” said an SEC spokesperson.

The development underscores the need for Nigerian policymakers to implement structural reforms aimed at stabilising the economy and strengthening the capital market’s appeal to global investors.

Leave a Reply