Industrial and General Insurance (IGI) has announced plans to raise fresh capital as part of its strategic efforts to meet Nigeria’s ongoing insurance industry recapitalisation requirements, while reaffirming its market confidence by paying out ₦1.8 billion in claims.

In a statement released by the company, IGI confirmed it is actively engaging investors and stakeholders to mobilize new funds that will bolster its financial position and ensure compliance with the National Insurance Commission’s (NAICOM) recapitalisation directive.

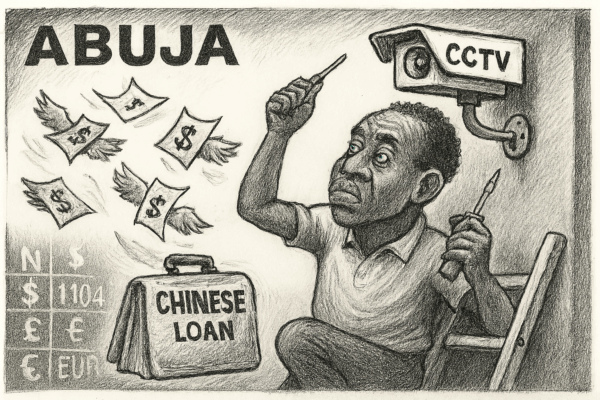

The recapitalisation move comes amid a broader push by regulators to strengthen the financial health of insurance firms in Nigeria and enhance their capacity to underwrite larger risks and drive sector growth.

According to IGI’s Head of Corporate Communications, the insurer has made significant progress in claims settlement, disbursing over ₦1.8 billion in the past year across various segments including life, general, and group insurance. The company emphasized that honoring claims promptly remains central to its customer trust and retention strategy.

“IGI remains committed to upholding its obligations to policyholders while working tirelessly to meet regulatory capital thresholds,” the spokesperson said. “This dual approach underlines our resolve to stay competitive and compliant.”

Industry analysts say IGI’s efforts could help reposition it as a key player in Nigeria’s evolving insurance landscape. “Timely claims settlement sends a strong message to the market, especially during recapitalisation. It’s about showing operational strength and trustworthiness,” said insurance analyst Femi Lawal.

NAICOM’s recapitalisation policy, which has been extended several times to allow insurers more time to comply, mandates that life insurance firms raise their capital base to ₦8 billion, general insurers to ₦10 billion, and composite insurers to ₦18 billion.

IGI’s renewed capital mobilisation plan is expected to involve a mix of equity investments and strategic partnerships, though specific details are yet to be disclosed.

As the insurance sector braces for regulatory deadlines, IGI’s combined focus on financial compliance and customer service may serve as a model for peers navigating similar challenges.

Leave a Reply