Pan-African banking giant Ecobank has successfully raised $125 million through a Eurobond issuance, reinforcing its strategic funding base to support lending, trade finance, and expansion across key African markets.

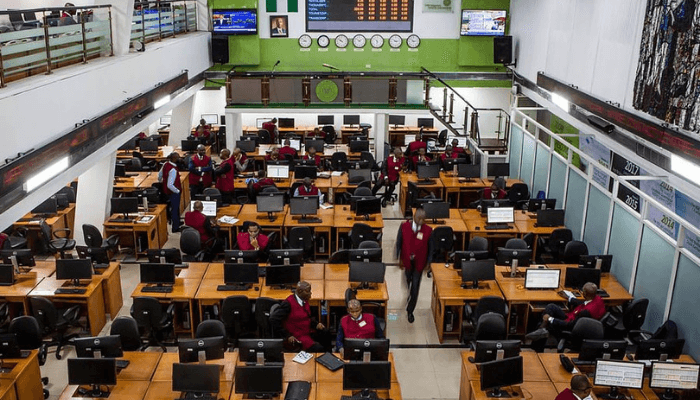

The financial move, announced on Tuesday, comes as the bank positions itself to leverage growing investor confidence in Africa’s economic recovery and deepen its footprint in both anglophone and francophone markets.

According to the bank, the senior unsecured bond—listed on the London Stock Exchange—was oversubscribed, reflecting strong appetite from global institutional investors seeking exposure to well-managed African financial institutions.

Jeremy Awori, Group CEO of Ecobank Transnational Incorporated (ETI), described the transaction as a vote of confidence in the bank’s pan-African strategy and long-term growth prospects. “This successful Eurobond issue is a clear demonstration of market trust in our business model, financial strength, and commitment to sustainable development across the continent,” he said.

Proceeds from the bond will be used to strengthen Ecobank’s capital buffers, refinance existing obligations, and increase financing to priority sectors including agriculture, SMEs, and renewable energy—areas viewed as critical to Africa’s inclusive economic growth.

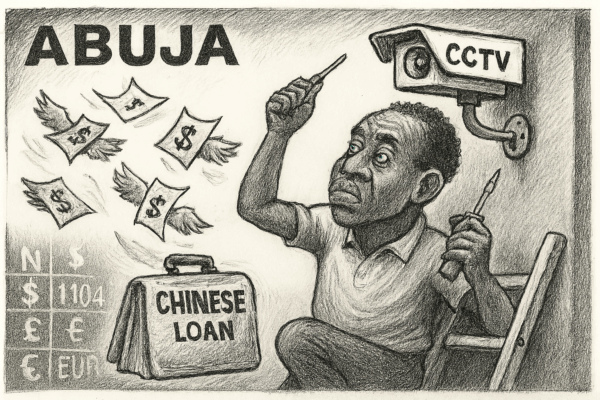

Analysts say the $125 million raise underscores a positive shift in sentiment toward African debt markets, which have faced volatility in recent years due to global interest rate hikes and geopolitical uncertainty.

Ecobank, which operates in over 30 African countries, is expected to continue using capital market instruments to diversify its funding sources and reduce reliance on short-term borrowing.

The Eurobond matures in five years and carries a competitive interest rate, though exact terms have not been publicly disclosed. This marks another key step in Ecobank’s broader efforts to align with Basel III standards and bolster investor confidence.

Market observers note that with this successful issuance, Ecobank has reaffirmed its status as one of Africa’s most resilient and forward-looking financial institutions.

Leave a Reply