In a bold move to strengthen Nigeria’s entrepreneurial ecosystem, the Development Bank of Nigeria (DBN) has announced plans to roll out a N500 billion credit guarantee programme aimed at improving access to finance for Micro, Small, and Medium Enterprises (MSMEs) across the country.

The initiative, which is part of DBN’s broader mandate to catalyze sustainable economic growth through financial inclusion, is expected to mitigate the credit risk that has long discouraged commercial banks from lending to small businesses.

Speaking at a stakeholders’ forum in Lagos on [Insert Date], DBN Managing Director, Dr. Tony Okpanachi, said the guarantee scheme will significantly de-risk lending to MSMEs and encourage financial institutions to expand their credit portfolios to underserved sectors.

“Access to finance remains one of the biggest challenges faced by MSMEs in Nigeria,” Okpanachi noted. “With this N500 billion guarantee window, we aim to break that barrier by providing comfort to lenders while empowering entrepreneurs to scale their operations.”

According to DBN, the scheme will target high-impact sectors such as agriculture, manufacturing, healthcare, and technology, with special consideration for women- and youth-owned enterprises.

Experts have hailed the move as timely, especially amid rising inflation and declining consumer purchasing power, which have squeezed the operational capacities of small businesses.

“This is a game-changer,” said Adetola Adewale, an economist and SME consultant. “Guarantee schemes are essential in economies like ours, where lending is often skewed toward low-risk, high-revenue clients, leaving MSMEs behind.”

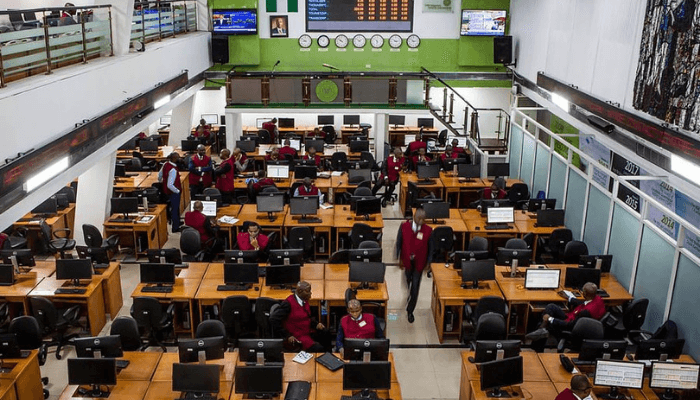

DBN said it will work closely with commercial banks, microfinance institutions, and other development finance partners to ensure effective deployment and monitoring of the guarantee facility.

With over 39 million MSMEs contributing nearly 50% to Nigeria’s GDP and employing over 80% of the workforce, stakeholders believe that improving their access to credit is crucial for long-term economic resilience and inclusive growth.

Leave a Reply