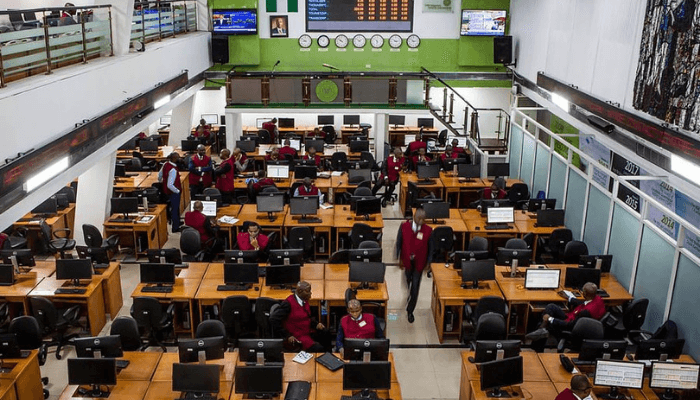

Nigeria’s stock market continues to showcase its depth and resilience, with a select group of listed companies achieving market capitalisations exceeding ₦1 trillion — solidifying their positions as dominant players in the country’s corporate landscape.

According to data from the Nigerian Exchange Group (NGX), the companies span sectors ranging from telecommunications and banking to consumer goods and energy, reflecting a diversified economy anchored by a few high-performing giants.

Titans of the Market

Leading the pack is MTN Nigeria, the telecommunications powerhouse, which has consistently held its position as one of the most valuable firms on the NGX. With its extensive customer base and growing fintech operations, MTN’s market cap has surged well beyond the ₦1 trillion mark.

Closely following is Dangote Cement, Africa’s largest cement producer, driven by strong domestic demand and ongoing regional expansion. The company’s market dominance is further buoyed by its integration into infrastructure development projects across the continent.

Other notable companies in the ₦1 trillion club include:

- BUA Cement, a rival in the construction materials space with steady revenue growth and increased production capacity.

- Airtel Africa, which continues to post impressive earnings from mobile data and financial services across multiple African markets.

- Zenith Bank and Guaranty Trust Holding Company (GTCO), both of which have benefited from solid asset growth, digital innovation, and strategic diversification.

- Seplat Energy, leveraging its strong oil and gas portfolio amid rising global energy prices.

- Nestlé Nigeria, a long-standing consumer goods leader with a strong brand and consistent dividend history.

Market Confidence and Investor Sentiment

Analysts say the performance of these companies signals robust investor confidence and highlights the underlying potential of Nigeria’s private sector, even in the face of macroeconomic challenges such as inflation, naira depreciation, and regulatory uncertainty.

“These firms are not just market leaders — they are benchmarks for stability and innovation in the Nigerian economy,” said Ugo Nwosu, a Lagos-based equity analyst. “Investors look to them for steady returns and long-term value.”

Broader Implications for the Economy

The presence of multiple trillion-naira companies also boosts Nigeria’s appeal to foreign investors, many of whom seek exposure to large-cap, blue-chip stocks with regional influence.

Market experts believe continued reforms in the capital market, improved corporate governance, and expansion into non-oil sectors could see more firms join the ₦1 trillion league in the coming years.

As Nigeria works to deepen its financial markets and attract capital, these corporate giants will likely play a crucial role in shaping the country’s economic trajectory.

Leave a Reply