A fresh wave of controversy has erupted in Nigeria’s downstream oil sector as fears mount over a potential federal ban on fuel imports — a move that could reshape the industry and reignite tensions between the Dangote Refinery and independent petroleum marketers.

At the centre of the row is the Dangote Petroleum Refinery, which recently commenced supply of Automotive Gas Oil (diesel) and aviation fuel to the domestic market. As expectations grow for the refinery to fully meet Nigeria’s petrol demand, speculation has intensified that the federal government may soon restrict or ban the importation of Premium Motor Spirit (PMS), commonly known as petrol.

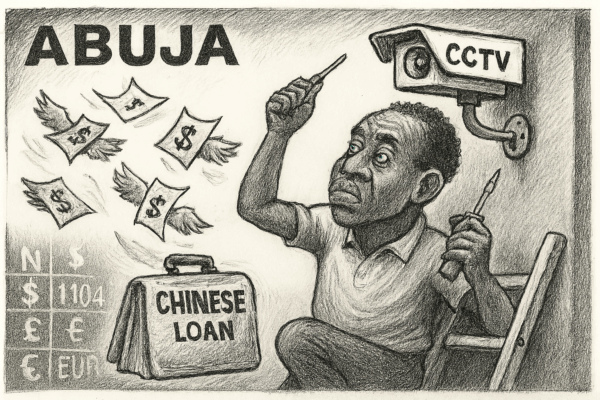

Independent marketers and industry groups have voiced concerns over the possibility of a forced dependency on the Dangote Refinery, which they argue could result in pricing monopolies, limited competition, and uncertain supply chains.

“The market should remain open and competitive. A ban on fuel imports now, when local refining capacity is still ramping up, could expose us to supply risks and distort pricing,” said Chinedu Okoronkwo, National President of the Independent Petroleum Marketers Association of Nigeria (IPMAN).

The Dangote Group, however, insists that its refinery — the largest single-train facility in the world with a 650,000 barrels per day capacity — is capable of satisfying national demand once crude supply stabilises and operational output peaks.

“Local refining is the future of energy security in Nigeria,” said a senior Dangote executive who asked not to be named. “We are offering a sustainable solution to decades of import dependency. The goal is not monopoly, but self-reliance.”

Earlier this year, the Nigerian Midstream and Downstream Petroleum Regulatory Authority (NMDPRA) hinted at the government’s intent to prioritise local refining in a bid to save foreign exchange and reduce fuel subsidy pressures. However, no formal policy on banning imports has been announced.

Industry insiders fear that uncertainty around the government’s stance is fuelling anxiety in the market. “There’s a trust deficit between private refiners and marketers. What we need is clarity, not speculation,” said an oil analyst at SBM Intelligence.

As the Dangote Refinery expands its distribution network, stakeholders are calling on the federal government to provide transparent guidelines on future import policy, pricing regulations, and competitive safeguards.

The outcome of this looming policy decision could have profound implications for fuel pricing, energy security, and investor confidence in Africa’s largest economy.

Leave a Reply